In a remarkable development, Taiwan Semiconductor Manufacturing Company (TSMC) is set to roll out its groundbreaking 2nm manufacturing process a full six months ahead of schedule. This announcement, made during an equipment delivery ceremony at its new 2nm fab in Kaohsiung on November 26th, 2024, signals TSMC's dominance in the semiconductor industry and its readiness to meet the explosive demand driven by AI applications. With its forward-thinking strategy, TSMC is positioning itself at the forefront of the next generation of advanced process technologies.

Early Rollout: A Response to Surging Demand

Originally, TSMC planned to introduce equipment to the Kaohsiung fab by mid-2025, with production slated to begin by the end of that year. However, due to unprecedented demand, the timeline has been advanced, with 2nm production capacity set to begin in 2025, ahead of initial projections. The global semiconductor market, particularly driven by the surge in generative AI technologies, has led to this accelerated schedule, placing TSMC in a prime position to dominate the advanced process technology market.

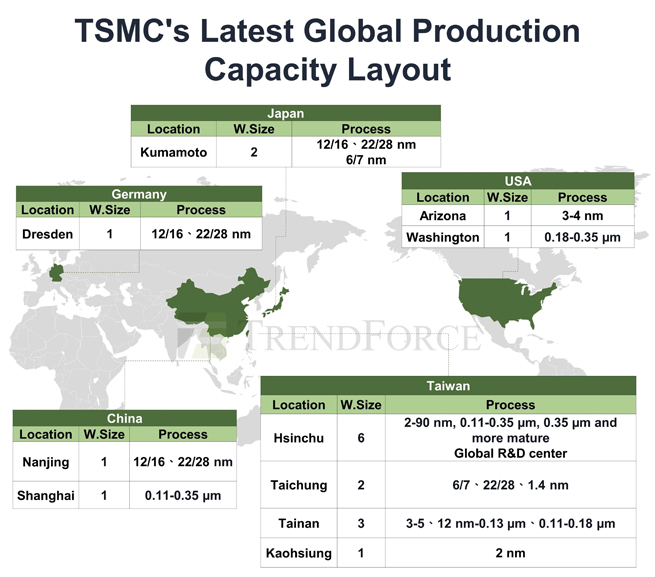

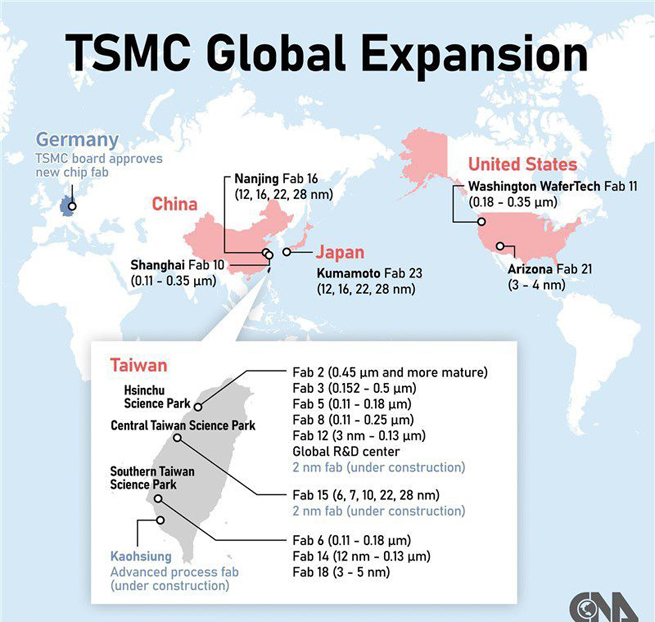

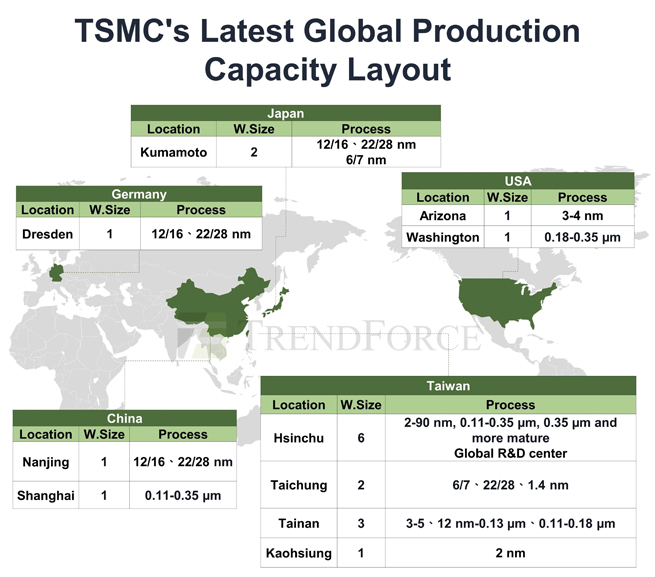

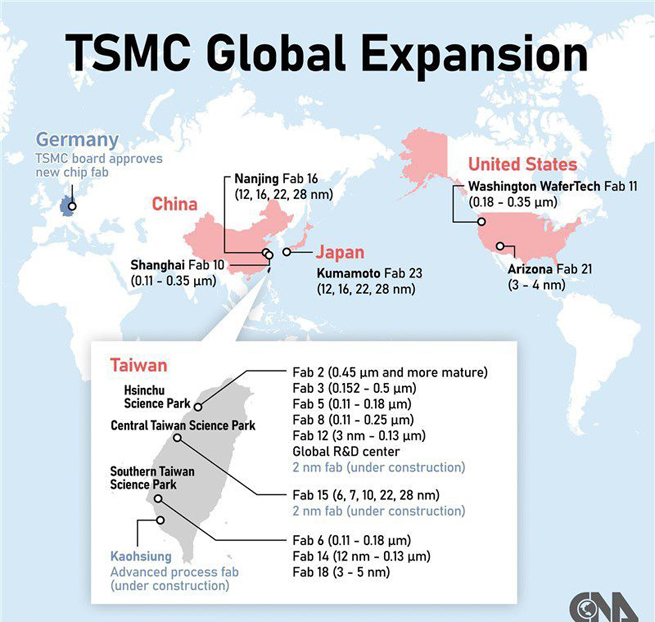

TSMC's Strategic Fab Distribution and Expansion

By 2026, TSMC's 2nm process will have an impressive total monthly production capacity of 90,000 wafers. This is made possible by the network of advanced fabs TSMC has established across Taiwan. Specifically, the new F20 fab in Hsinchu and F22 in Kaohsiung will contribute to the production of 2nm chips, with the latter scheduled for commercial production in the first quarter of 2026. The expansion of TSMC's capacity underscores the company's commitment to meeting the growing global demand for more powerful, energy-efficient chips.

As the demand for TSMC's 5nm and 3nm chips already exceeds supply, the launch of the 2nm process will allow TSMC to maintain its leadership in the semiconductor market, providing a stable and reliable supply chain for cutting-edge chip technologies.

Generative AI: A Game-Changer for TSMC's 2nm Strategy

The timing of TSMC’s 2nm process rollout is perfect, coinciding with the rapid growth of AI-driven demand. After a challenging period in 2023, the semiconductor market rebounded strongly in 2024, driven largely by the AI boom. TSMC's market performance reflects this trend, with a 29.2% year-on-year increase in revenue by October 2024. As AI technologies continue to evolve, the demand for powerful, high-performance chips like those produced using TSMC's 2nm process is expected to grow exponentially.

TSMC's Chairman and CEO, C.C. Wei, has confirmed that AI-related demand is pushing the company’s advanced processes, including 2nm, into unprecedented territory. As a result, the demand for TSMC's 2nm chips is anticipated to exceed that of the 3nm process, further solidifying TSMC's position as the go-to supplier for AI chip technologies.

Local Support: A Strategic Advantage for TSMC

In addition to strong market demand, TSMC benefits from significant local government support in Taiwan. Kaohsiung, the site of the new 2nm fab, has seen extensive infrastructure investments, including improvements to transportation and educational facilities to support TSMC’s operations and its growing workforce. Local authorities have coordinated with material and equipment suppliers to set up operations in Kaohsiung, ensuring that TSMC has the resources it needs to ramp up production efficiently.

This level of coordination and support from local government agencies is vital to TSMC’s success, especially as it faces competition from other semiconductor giants.

Apple and AMD: Key Buyers of 2nm Chips

TSMC’s 2nm chips are already in high demand, with major players like Apple and AMD among the expected buyers. Apple, a long-time partner of TSMC, is anticipated to be one of the first to adopt 2nm chips for its future devices, including the iPhone 18 Pro series in 2026. The close relationship between the two companies means that Apple will continue to rely on TSMC’s cutting-edge technology for its next-generation devices.

Similarly, AMD, which has already used TSMC’s 3nm chips for its latest processors, is expected to adopt the 2nm process for its upcoming chip releases, further expanding the market for TSMC’s advanced chips.

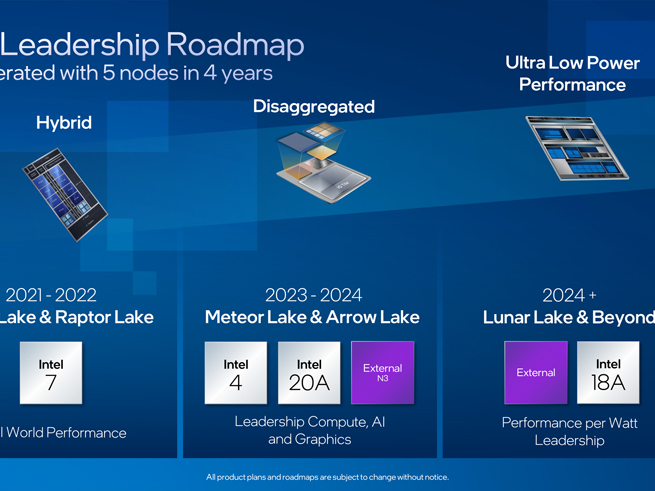

The Competitive Landscape: TSMC’s Dominance and the Challenges Ahead

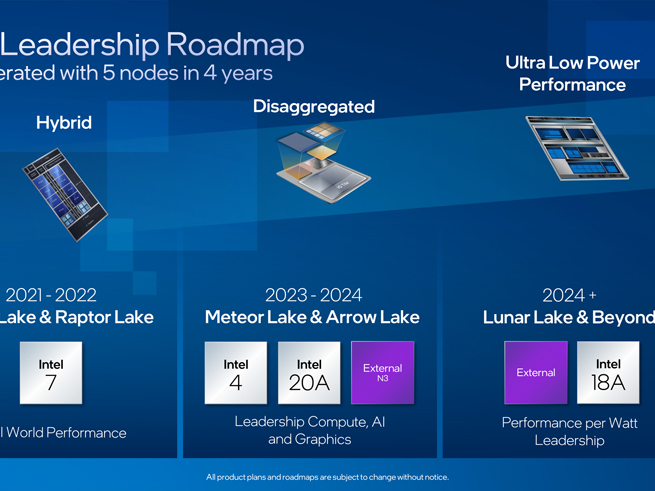

While TSMC continues to lead the way in 2nm process development, its competitors are also making strides. Samsung, for example, plans to begin production of 2nm chips by 2025, though its progress has been slower, with challenges in yield rates and customer orders for its 3nm process. Intel is also vying for a piece of the advanced process pie, with its 18A process expected to launch in 2025.

However, TSMC’s clear lead in the 2nm race and its solid customer base suggest that it will continue to dominate the semiconductor industry for the foreseeable future. The company’s relentless focus on innovation, combined with its strong customer relationships, ensures that it remains the preferred supplier for advanced chip technologies.

Looking Ahead: TSMC’s Road to 1nm and Beyond

While TSMC’s 2nm process is already making waves, the company is not resting on its laurels. TSMC is actively preparing for even smaller nodes, with its 1.6nm (A16) process slated for production in 2026. This next-generation technology promises even greater performance improvements, including reduced power consumption and increased transistor density.

As the semiconductor industry continues to push the boundaries of what is possible, TSMC’s continued investment in research and development ensures that it will remain a leader in advanced process technologies for years to come.

TSMC’s Unstoppable Momentum

With its early rollout of the 2nm process, TSMC is poised to cement its position as the global leader in semiconductor manufacturing. The company’s perfect timing, local support, and strong partnerships with key players like Apple and AMD set the stage for continued success. As TSMC looks to the future, its commitment to innovation and its ability to meet the ever-growing demand for powerful, energy-efficient chips will keep it ahead of the competition. There is little that can stop TSMC now as it enters a new era of semiconductor excellence.

By Jennifer Tseng

Hi, I'm Jennifer, Marketing Executive at lanaotek.com.

I specialize in translating cutting-edge optical and Ethernet transmission technologies into clear, valuable insights that help our customers stay ahead in a fast-evolving digital world.

By turning complex technical concepts into practical, business-driven content, I aim to empower decision-makers with the knowledge they need to make confident, future-ready choices.

Internet Data Center

Internet Data Center FAQs

FAQs Industry News

Industry News About Us

About Us Data Center Switch

Data Center Switch  Enterprise Switch

Enterprise Switch  Industrial Switch

Industrial Switch  Access Switch

Access Switch  Integrated Network

Integrated Network  Optical Module & Cable

Optical Module & Cable

Call us on:

Call us on:  Email Us:

Email Us:  2106B, #3D, Cloud Park Phase 1, Bantian, Longgang, Shenzhen, 518129, P.R.C.

2106B, #3D, Cloud Park Phase 1, Bantian, Longgang, Shenzhen, 518129, P.R.C.