The optical module industry has been undergoing a period of intense growth and innovation, as market players scramble to secure a foothold in a competitive space that has long been dominated by a handful of key global players. Recently, on January 16th, stock prices for optical module companies such as Tianfu Communication, Bocheng Technology, Deco, Zhongji Xuchuang, Xinyisheng, Liante Technology, and Accelink Technologies saw significant jumps, signaling optimism and a possible shift in industry dynamics.

The Rising Importance of Optical Modules

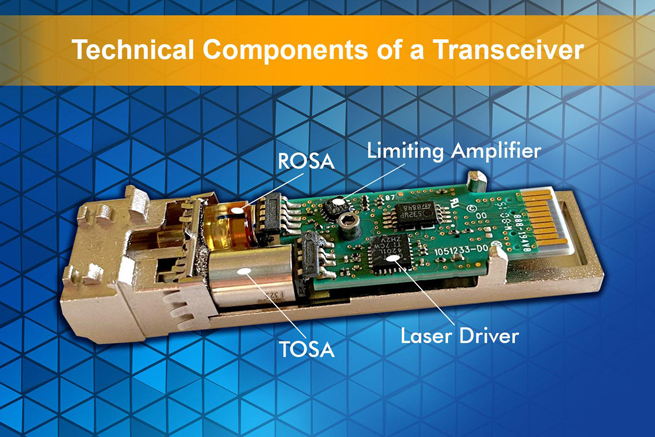

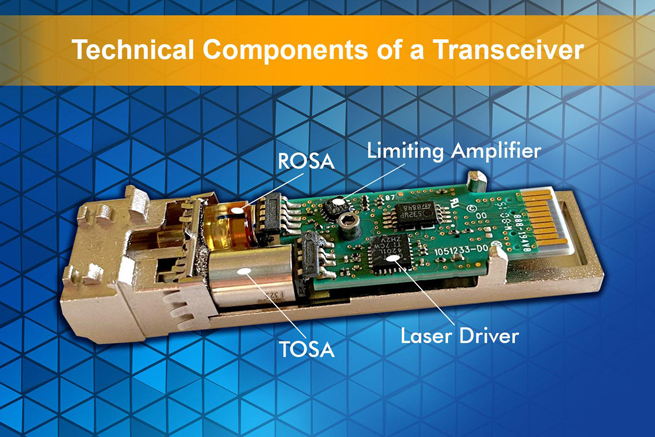

Optical modules are critical components in the optical communication industry, enabling the conversion between light and electricity. These modules are used across a wide range of applications, from telecommunications and data centers to consumer electronics. However, despite their pivotal role, the industry has traditionally faced significant challenges, including low barriers to entry and fierce competition.

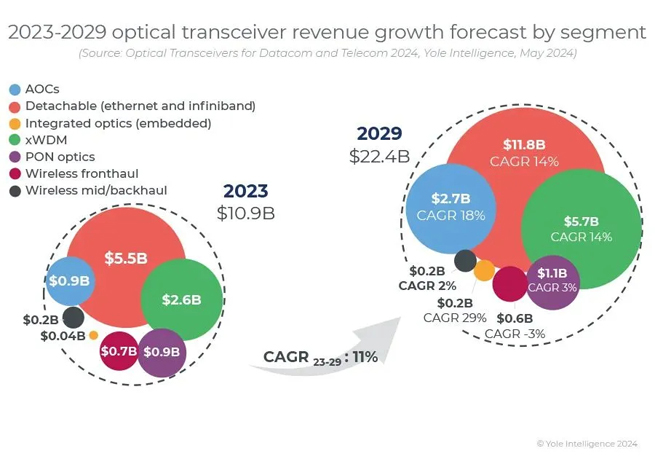

Manufacturing optical modules is primarily an assembly process, which has led to a highly fragmented market. The top players have struggled to capture more than a small share of the total market. According to a report by Yole, in 2020, the optical module manufacturer with the largest market share, Finisar, only held 16%, with Lumentum trailing closely behind at 11%. This low concentration (with a CR5 of only 63%) highlights the fiercely competitive and fragmented nature of the industry.

Market Saturation and the Role of Innovation

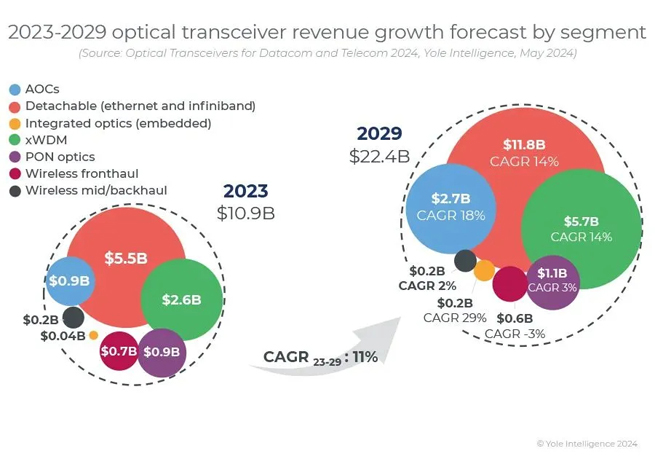

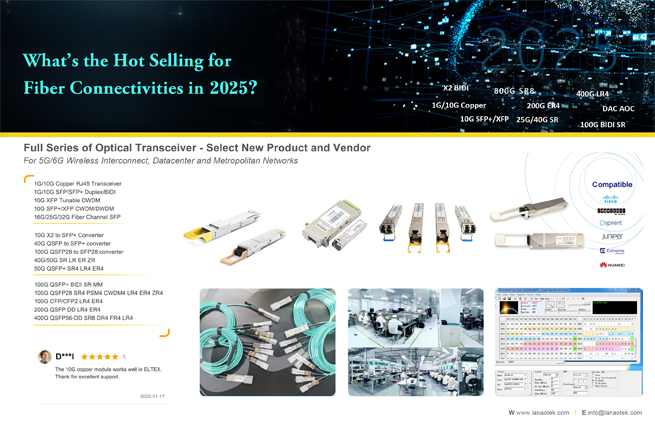

The optical module market is a classic example of a "red ocean," where companies must constantly innovate to stay relevant. Historically, when a new optical module technology was introduced, such as the 10G modules in the early 2000s, the initial prices were high. However, as more players caught up with the technology, prices typically fell by 10% to 20% annually, squeezing profit margins and forcing companies to continuously develop newer, faster modules.

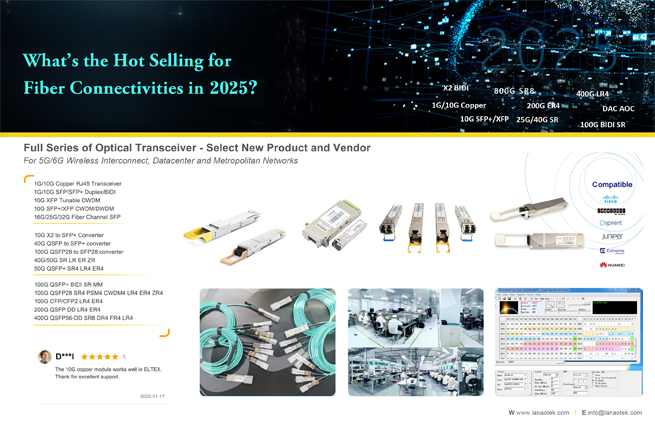

For instance, 10G optical modules, which were once the gold standard, are now being phased out as the need for higher-speed options like 25G, 40G, and even 100G modules becomes more pronounced. As internet speeds and data traffic continue to grow exponentially, the demand for higher-speed optical modules is inevitable, driving the market toward more advanced solutions.

This constant "cycle" of technological innovation and price reduction is often referred to as "involution." However, in recent years, optical module companies have started to break this cycle by focusing on core technological advancements, particularly in optical chips, which are crucial to developing higher-performance modules.

The Shift Toward Chip Independence

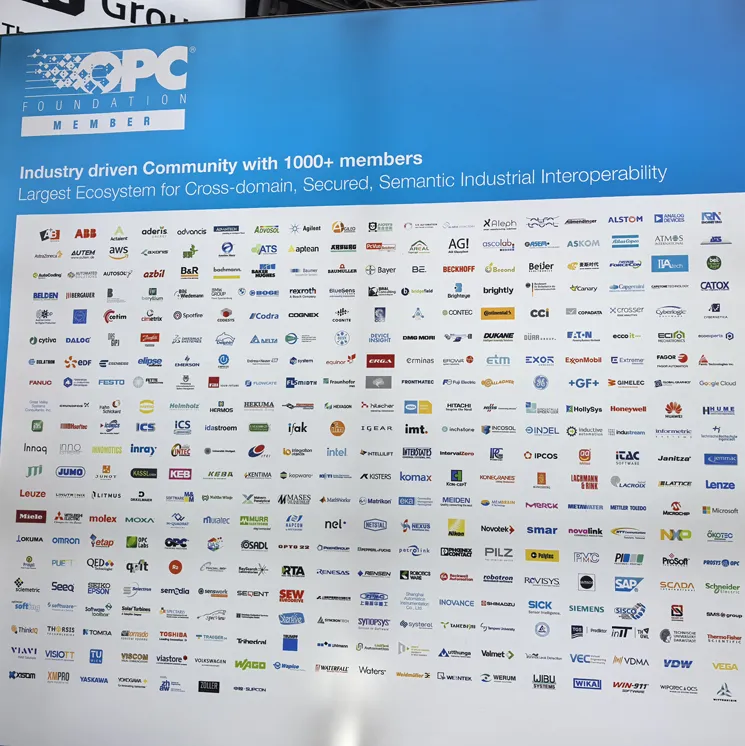

In a bid to differentiate themselves and achieve more control over the supply chain, optical module manufacturers have increasingly focused on the upstream chip sector. This move allows companies to reduce their dependence on foreign suppliers and take a more active role in the high-end optical module market.

Several domestic optical module manufacturers in China have now achieved full product coverage in the 10G, 25G, 40G, 100G, and even 400G transmission rate sectors. In fact, some domestic manufacturers have even taken the lead in the next-generation 800G module market, launching products faster than their international counterparts. Furthermore, Chinese companies have made significant progress in optical chip production, with some now capable of mass-producing 10G DFB and 10G EML chips, and even 25G DFB and 25G EML chips.

A Market Shifting Toward Domestic Players

In 2015, Accelink Technologies was the only Chinese company among the world’s top 10 optical module manufacturers. By 2020, however, the landscape had changed dramatically, with several Chinese companies making it into the top 10, including InnoLight Technology, Hisense Broadband, Accelink Technologies, Sumitomo, and HG Genuine Optical Modules. Domestic manufacturers now account for over 30% of the global market share.

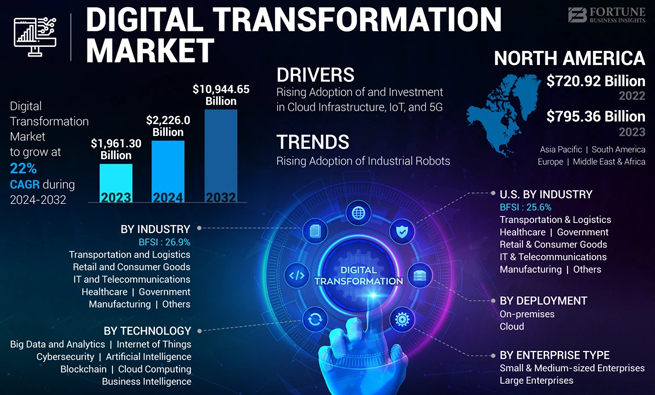

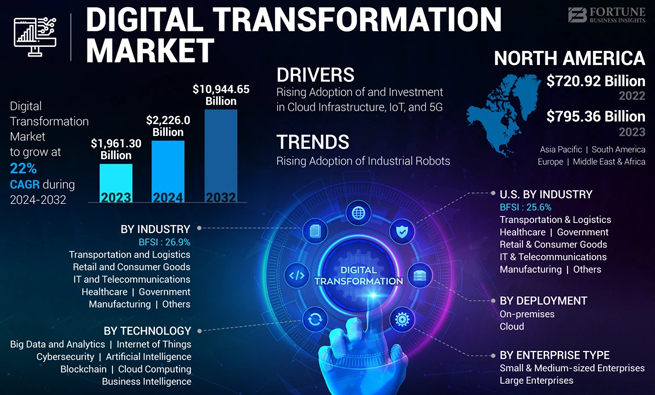

The Role of Emerging Technologies in Driving Demand

The surge in demand for optical modules is being fueled by the rapid growth of emerging technologies such as the metaverse, cloud computing, AI, and 5G. These technologies require significant amounts of data transmission and storage, placing immense pressure on telecom operators and cloud service providers to upgrade their infrastructure.

As telecom operators and cloud providers increase their capital expenditure to meet this demand, the optical module market stands to benefit. Optical module companies that can scale up production quickly and produce at a lower cost are expected to gain the most from this period of explosive growth.

The Promise of Self-Sufficiency in Optical Chips

One of the key strategies that will determine which optical module companies rise to dominance is achieving self-sufficiency in optical chips. By controlling the production of optical chips, manufacturers can significantly reduce their production costs and improve their gross profit margins.

Currently, the gross profit margin for most optical module companies ranges between 20% and 30%. However, if companies can fully control the optical chip production process, margins could rise as high as 55%. This would provide a significant competitive edge in the market, as it would allow companies to reduce costs and offer more attractive pricing.

Notable Moves by Industry Leaders

Some of the leading domestic players, including Accelink Technologies and HGTECH, have already made significant moves to expand into the optical chip sector. Accelink Technologies, for example, acquired Denmark’s IPX in 2012 and France’s Almae in 2016, gaining critical mass production capabilities for passive and active optical chips. Similarly, HGTECH entered the optical chip market in 2018 by establishing Wuhan Yunling Optoelectronics, which now produces a wide range of optical chips and is among the top performers in China.

As the growth of semiconductor and optical chip technologies continues, these companies are well-positioned to capture a larger share of the optical module market. Looking at the success of overseas leaders like Finisar and Lumentum, it is clear that controlling both upstream chips and downstream modules is the key to becoming a dominant force in the industry.

Who Will Rise to the Top?

With technological breakthroughs and the expansion of production capacity, companies like Accelink Technologies and HGTECH are likely to secure a significant share of the optical module market. The key to success will be their ability to maintain a first-mover advantage in the optical chip sector while continuing to innovate in the optical module space.

As demand for high-speed optical modules continues to soar, it is clear that the future of the industry will be shaped by those who can offer the most advanced products at the lowest costs. In this competitive landscape, the next generation of optical module giants will rise from a combination of technological prowess, strategic acquisitions, and efficient supply chain management.

By Jennifer Tseng

Hi, I'm Jennifer, Marketing Executive at lanaotek.com.

I specialize in translating cutting-edge optical and Ethernet transmission technologies into clear, valuable insights that help our customers stay ahead in a fast-evolving digital world.

By turning complex technical concepts into practical, business-driven content, I aim to empower decision-makers with the knowledge they need to make confident, future-ready choices.

Internet Data Center

Internet Data Center FAQs

FAQs Industry News

Industry News About Us

About Us Data Center Switch

Data Center Switch  Enterprise Switch

Enterprise Switch  Industrial Switch

Industrial Switch  Access Switch

Access Switch  Integrated Network

Integrated Network  Optical Module & Cable

Optical Module & Cable

Call us on:

Call us on:  Email Us:

Email Us:  2106B, #3D, Cloud Park Phase 1, Bantian, Longgang, Shenzhen, 518129, P.R.C.

2106B, #3D, Cloud Park Phase 1, Bantian, Longgang, Shenzhen, 518129, P.R.C.