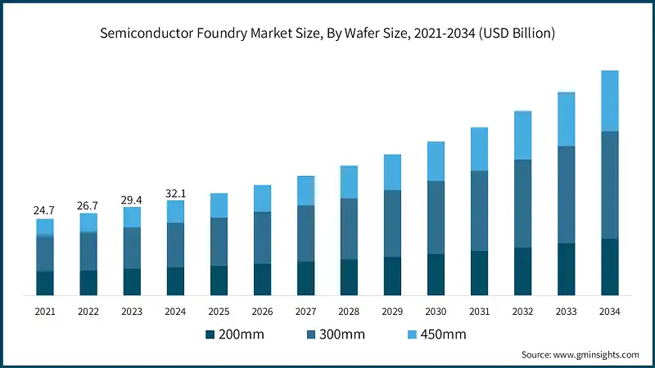

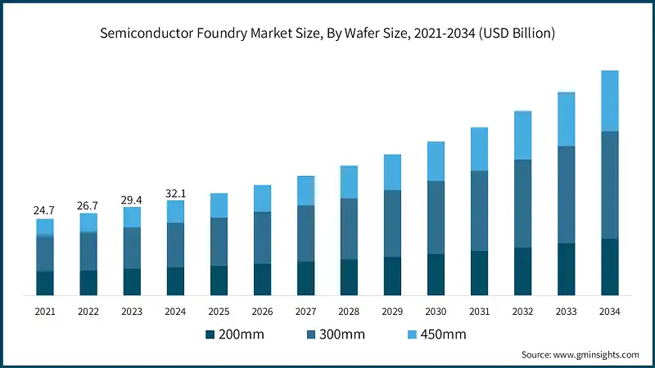

The global wafer foundry industry is poised for impressive growth, with revenue projections expected to rise by 20% in 2025. This surge is driven by an uptick in demand for advanced semiconductor processes, along with the rapid integration of artificial intelligence (AI) technologies in data centers and edge computing. According to a recent report by market analysis firm Counterpoint, this growth marks a continuation of the industry's strong performance, with year-on-year growth of 22% anticipated for 2024.

As the semiconductor landscape evolves, the wafer foundry sector is navigating both opportunities and challenges, as advanced manufacturing nodes continue to play a central role in driving the next generation of tech products. Let's delve into the key trends shaping the wafer foundry market and what they mean for industry players.

Key Drivers of Wafer Foundry Revenue Growth

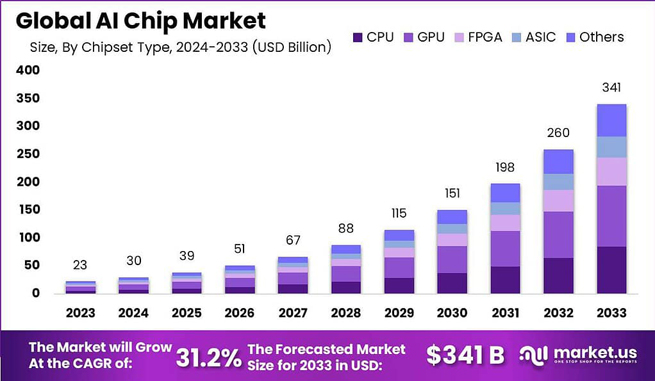

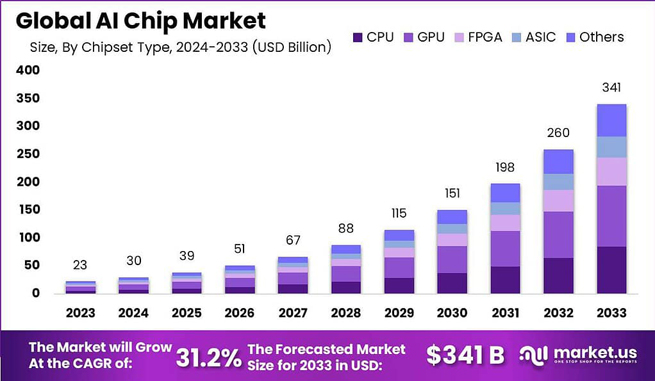

The projected 20% revenue growth for 2025 is primarily attributed to the increasing demand for advanced semiconductor processes, particularly in AI-powered applications. With AI becoming a central component of emerging technologies like cloud computing, autonomous vehicles, and the metaverse, the need for more powerful chips is skyrocketing. Nvidia's AI chips, for example, have become critical for AI training and inference tasks, spurring strong demand from data centers and enterprises.

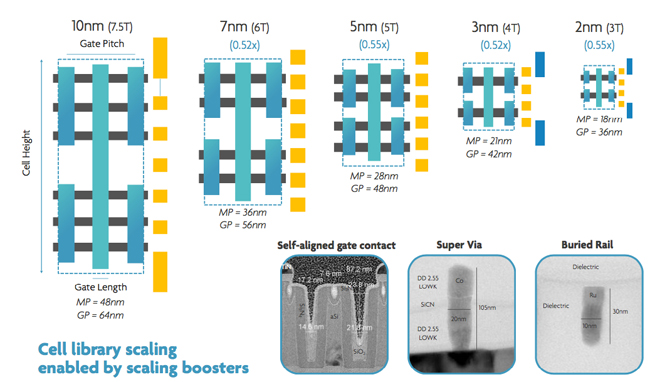

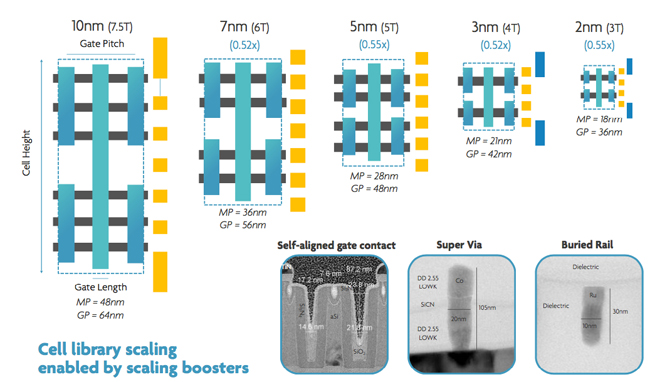

Moreover, the fast-growing AI sector has prompted a need for cutting-edge chip technologies, driving manufacturers to invest heavily in advanced processes, particularly 3nm and 5/4nm nodes. These leading-edge nodes are crucial for producing smaller, more efficient chips that can meet the intense performance requirements of AI workloads, with high-performance computing (HPC) and edge computing applications leading the charge.

Counterpoint's analysis suggests that from 2026 to 2028, the wafer foundry industry will continue to see robust growth, with an expected annual growth rate between 13% and 18%. This sustained expansion is largely attributed to the continued adoption of advanced packaging and process technologies, which are key to producing the next-generation semiconductors that power AI, 5G, and other high-demand applications.

Strong Demand for Nvidia AI Chips and Smartphone Processors

Nvidia's dominance in the AI chip market is a major factor driving demand for leading-edge wafer nodes. The company has seen substantial growth in both its data center and automotive business segments, contributing to a surge in demand for high-performance AI chips. With AI set to revolutionize industries across the board, Nvidia is positioned as a key player in the semiconductor supply chain.

In addition to AI chips, the demand for flagship smartphone processors from companies like Apple, Qualcomm, and MediaTek is expected to keep wafer foundries operating at full capacity. With the increasing complexity of mobile devices, including the incorporation of 5G connectivity and AI features, there is a continuous need for more advanced semiconductor nodes. These high-performance chips are critical to meeting consumer demand for faster, more efficient mobile devices.

As these flagship smartphones drive substantial demand, wafer foundries will continue to benefit from the sustained volume of production orders. However, the industry’s ability to maintain high utilization rates will depend on the balance between emerging technologies like AI and the more traditional consumer electronics markets.

Challenges in Mature Process Nodes

While the leading-edge 3nm and 5/4nm nodes are experiencing high utilization rates, the situation is different for the mature wafer nodes, including 28nm, 22nm, and above. These nodes, which are typically used in less complex semiconductors for consumer electronics, automotive, and industrial markets, are seeing slower recovery in terms of capacity utilization.

One key factor behind this slowdown is weak demand in certain end markets, particularly in consumer electronics, networking, and industrial applications. Although these mature process nodes are still crucial for a range of products, including legacy semiconductor components, they face competition from newer, more efficient manufacturing technologies.

The automotive and industrial sectors, which are among the primary sources of orders for these mature processes, are grappling with several challenges, including supply chain disruptions and fluctuating demand. Additionally, the high inventory levels maintained by integrated device manufacturers (IDMs) like Infineon and NXP have led to an oversupply of semiconductors in the market, further hindering the recovery of outsourced wafer foundry orders.

Challenges for 8-Inch Wafer Foundries

Another challenge facing the wafer foundry market is the slower recovery of capacity utilization for 8-inch wafer foundries, particularly in comparison to 12-inch wafer processes. These smaller wafer sizes are primarily used for automotive and industrial semiconductors, which have been impacted by significant risks in the market.

The automotive semiconductor market, in particular, has faced disruptions due to the global chip shortage and ongoing supply chain issues. As automotive manufacturers adjust their production strategies to accommodate these challenges, the demand for outsourced wafer foundry services has been less consistent.

Despite these challenges, some 8-inch wafer foundries are finding new opportunities in niche markets, such as power semiconductors for electric vehicles (EVs) and industrial automation. However, the overall recovery for these wafer nodes remains more sluggish than for the advanced nodes, creating a bifurcation in the industry’s growth trajectory.

Looking Ahead: A Stronger Industry with Focused Innovation

Looking to the future, the wafer foundry industry is poised for continued growth, driven by technological innovation and demand for advanced semiconductor processes. While the industry faces challenges, particularly in the mature process nodes and 8-inch wafer foundries, the overall outlook remains positive, with strong demand from AI, high-performance computing, 5G, and consumer electronics.

Wafer foundries that focus on the development of advanced processes and packaging technologies will be well-positioned to capitalize on the opportunities presented by the rapid evolution of AI and next-generation technologies. In particular, companies that can successfully integrate AI-driven design tools and maintain high capacity utilization in their advanced nodes will lead the charge in the next phase of growth.

By Jennifer Tseng

Hi, I'm Jennifer, Marketing Executive at lanaotek.com.

I specialize in translating cutting-edge optical and Ethernet transmission technologies into clear, valuable insights that help our customers stay ahead in a fast-evolving digital world.

By turning complex technical concepts into practical, business-driven content, I aim to empower decision-makers with the knowledge they need to make confident, future-ready choices.

Internet Data Center

Internet Data Center FAQs

FAQs Industry News

Industry News About Us

About Us Data Center Switch

Data Center Switch  Enterprise Switch

Enterprise Switch  Industrial Switch

Industrial Switch  Access Switch

Access Switch  Integrated Network

Integrated Network  Optical Module & Cable

Optical Module & Cable

Call us on:

Call us on:  Email Us:

Email Us:  2106B, #3D, Cloud Park Phase 1, Bantian, Longgang, Shenzhen, 518129, P.R.C.

2106B, #3D, Cloud Park Phase 1, Bantian, Longgang, Shenzhen, 518129, P.R.C.