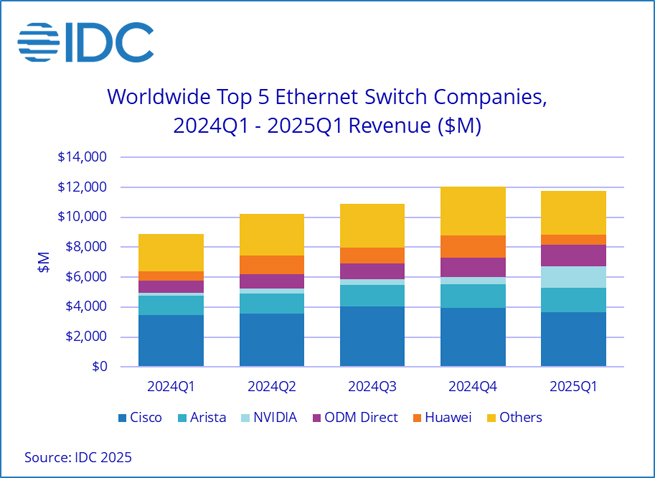

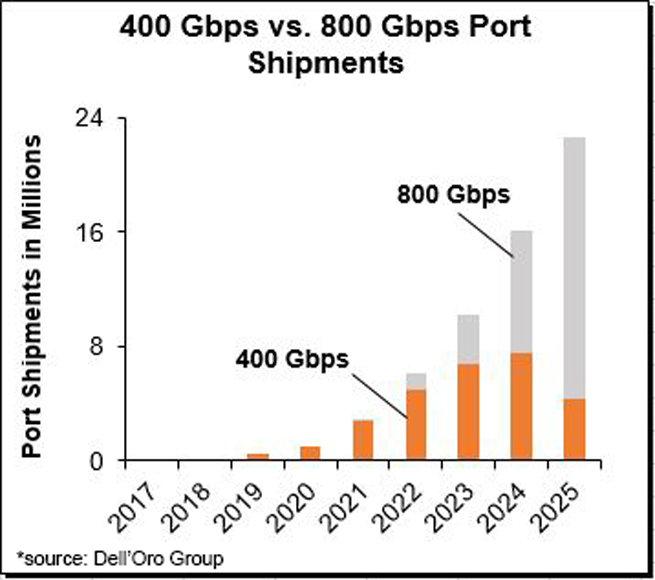

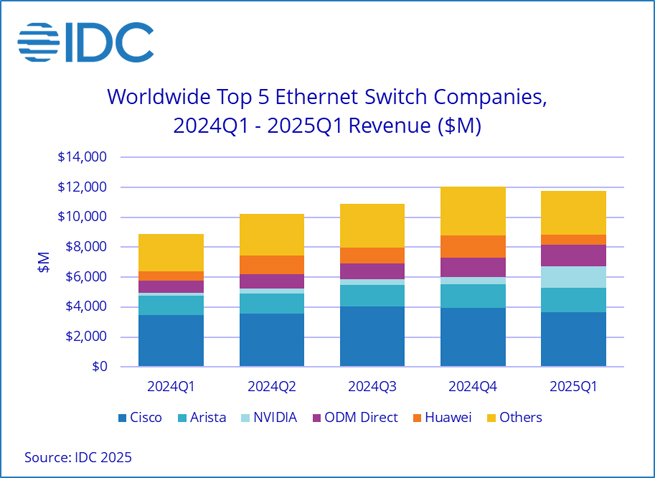

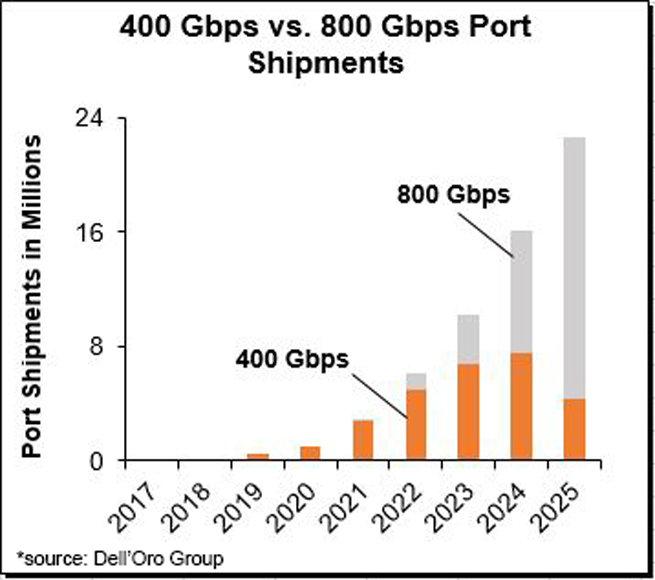

The final quarter of 2024 saw record-breaking growth in the Ethernet data center switch market, with AI-related spending playing a pivotal role in driving this surge. According to the latest report from Dell'Oro Group, Ethernet switch sales achieved impressive double-digit revenue growth, particularly in high-capacity 200 Gbps, 400 Gbps, and 800 Gbps port shipments. Among the standout performers, Celestica led the charge with the largest market share increase, alongside significant contributions from other major players like Arista, Nvidia, and Ruijie.

As the demand for high-speed data transmission continues to rise, fueled by AI innovations and growing cloud services, the data center networking sector is witnessing a shift in both demand patterns and spending behavior. This article explores the key drivers behind Q4 2024's data center switch sales growth and what it means for the future of the market.

AI-Driven Demand: The Key Factor Behind Growth

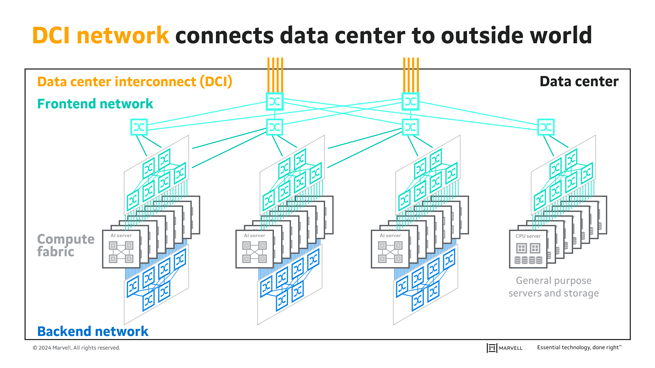

The primary catalyst for the surge in data center switch sales during Q4 2024 is undeniably the rapid expansion of artificial intelligence (AI) technologies. AI is pushing the limits of data processing and storage, creating a greater need for high-performance networking infrastructure that can support massive data flows. As enterprises and cloud service providers ramp up their AI-driven applications, the demand for Ethernet switches with high port speeds—such as 200 Gbps, 400 Gbps, and even 800 Gbps—has surged.

Nvidia, a leading provider of AI hardware, played a significant role in this trend. Its GPUs, essential for AI workloads, are often deployed in conjunction with high-bandwidth switches to ensure fast data transmission across data centers. The resulting growth in AI-related investments has not only boosted sales of Ethernet switches but has also prompted innovation in switch design to meet the growing need for speed and efficiency.

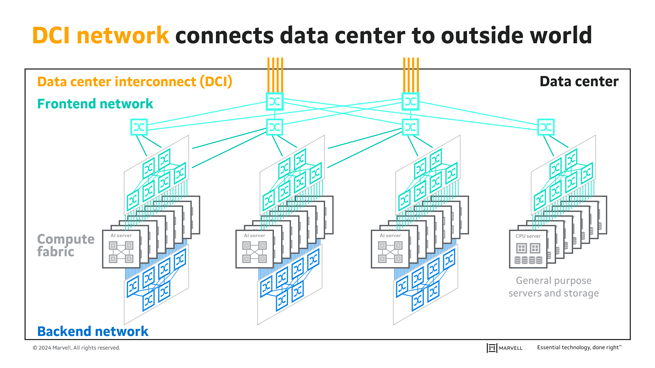

The demand for these advanced Ethernet switches is not limited to just AI data processing. They are also crucial for cloud infrastructure, where the need for scalable and high-performance networking is becoming more pronounced. As more businesses migrate their workloads to the cloud, Ethernet switches with high-speed capabilities are essential to supporting the scale and complexity of modern cloud environments.

A Robust Market: Celestica and Industry Leaders Take the Lead

Celestica emerged as a clear leader in the market, showing the largest increase in market share for Q4 2024. This growth can be attributed to the company’s ability to meet the demand for high-performance switches, which are essential for next-generation data centers. Celestica’s strong position highlights the increasing reliance on specialized vendors that can provide the infrastructure needed to support AI-driven initiatives.

Alongside Celestica, several other companies contributed significantly to the revenue growth in the data center switch market. Arista, known for its high-performance network switches, continued to benefit from the growing demand for scalable cloud infrastructure. The company’s strong focus on automation and high-speed networking made its products a popular choice for data centers aiming to enhance their AI and cloud capabilities.

Nvidia’s role in driving data center switch sales cannot be overstated. As AI adoption grows, the need for Nvidia’s GPU-accelerated servers has created a symbiotic relationship between AI workloads and the switches that interconnect them. The increased sales of AI-optimized infrastructure have a direct impact on the demand for Ethernet switches capable of handling high-speed, low-latency communication between processors and storage systems.

Ruijie, another prominent player in the data center switch market, has also contributed significantly to the overall growth. The company's product offerings cater to high-performance networking in both enterprise and cloud data centers, positioning them well to take advantage of the AI boom.

Recovery of Traditional Front-End Networks

While AI-related investments were the primary driver of growth in Q4 2024, there were also signs of recovery in traditional front-end networks, a trend that began with cloud service providers early in the year. Sameh Boujelbene, Vice President of Dell'Oro Group, highlighted that Q4 marked the first quarter of recovery for large enterprise spending. This shift indicates the end of the inventory digestion cycle that had been a lingering issue for many businesses in 2023.

As the market begins to stabilize, large enterprises are showing renewed confidence in expanding their network infrastructure. The recovery of front-end networks is essential for supporting the growing needs of both traditional business operations and newer, more data-intensive applications, including AI and cloud computing.

Cloud service providers were the first to show signs of recovery, with many returning to their growth trajectories in early 2024. By Q4, large enterprises followed suit, indicating that the overall health of the networking sector is improving. This recovery is expected to continue into 2025, as enterprises upgrade their infrastructure to meet the demands of increasingly complex digital ecosystems.

The Future of Data Center Switch Sales

The outlook for the data center switch market remains positive, with the continued growth of AI applications and cloud services driving demand for high-performance switches. The trend toward higher-speed Ethernet ports, such as 400 Gbps and 800 Gbps, will likely continue as data centers seek to future-proof their infrastructure against the rapidly increasing data demands of AI, IoT, and cloud computing.

As companies like Celestica, Arista, Nvidia, and Ruijie continue to innovate and expand their offerings, the competitive landscape will remain dynamic. Vendors that can provide solutions to support both AI workloads and traditional network demands will be well-positioned to capitalize on the ongoing growth of the data center sector.

One key development to watch is the increasing integration of AI in networking solutions themselves. With the growing need for real-time data processing and network optimization, AI-driven network management systems are expected to become a crucial part of the data center infrastructure. These systems will help optimize traffic flow, reduce latency, and improve overall network efficiency, further enhancing the capabilities of high-speed Ethernet switches.

A Market Driven by AI Innovation and Network Expansion

Q4 2024’s record-breaking growth in Ethernet data center switch sales is a testament to the growing importance of AI in the modern data ecosystem. While AI investments are driving the demand for high-speed networking infrastructure, the recovery of traditional front-end networks also signals a return to broader market growth. As AI continues to evolve and data center networks expand to meet the demands of the digital age, the data center switch market is set for continued success.

By Jennifer Tseng

Hi, I'm Jennifer, Marketing Executive at lanaotek.com.

I specialize in translating cutting-edge optical and Ethernet transmission technologies into clear, valuable insights that help our customers stay ahead in a fast-evolving digital world.

By turning complex technical concepts into practical, business-driven content, I aim to empower decision-makers with the knowledge they need to make confident, future-ready choices.

Internet Data Center

Internet Data Center FAQs

FAQs Industry News

Industry News About Us

About Us Data Center Switch

Data Center Switch  Enterprise Switch

Enterprise Switch  Industrial Switch

Industrial Switch  Access Switch

Access Switch  Integrated Network

Integrated Network  Optical Module & Cable

Optical Module & Cable

Call us on:

Call us on:  Email Us:

Email Us:  2106B, #3D, Cloud Park Phase 1, Bantian, Longgang, Shenzhen, 518129, P.R.C.

2106B, #3D, Cloud Park Phase 1, Bantian, Longgang, Shenzhen, 518129, P.R.C.